April's real estate market followed the established trend of 2025, marked by elevated inventory levels and corresponding decrease in sales activity. While home prices have remained relatively stable, this stability is partly attributed to some sellers opting to wait out the current market conditions.

Despite significant pent-up demand, economic uncertainty continues to act as ahead wind, preventing this demand from fully materializing. However, the conclusion of Canada's federal election has ended a period of market hesitancy, and we anticipate this will encourage both new buyers and sellers to enter the market.

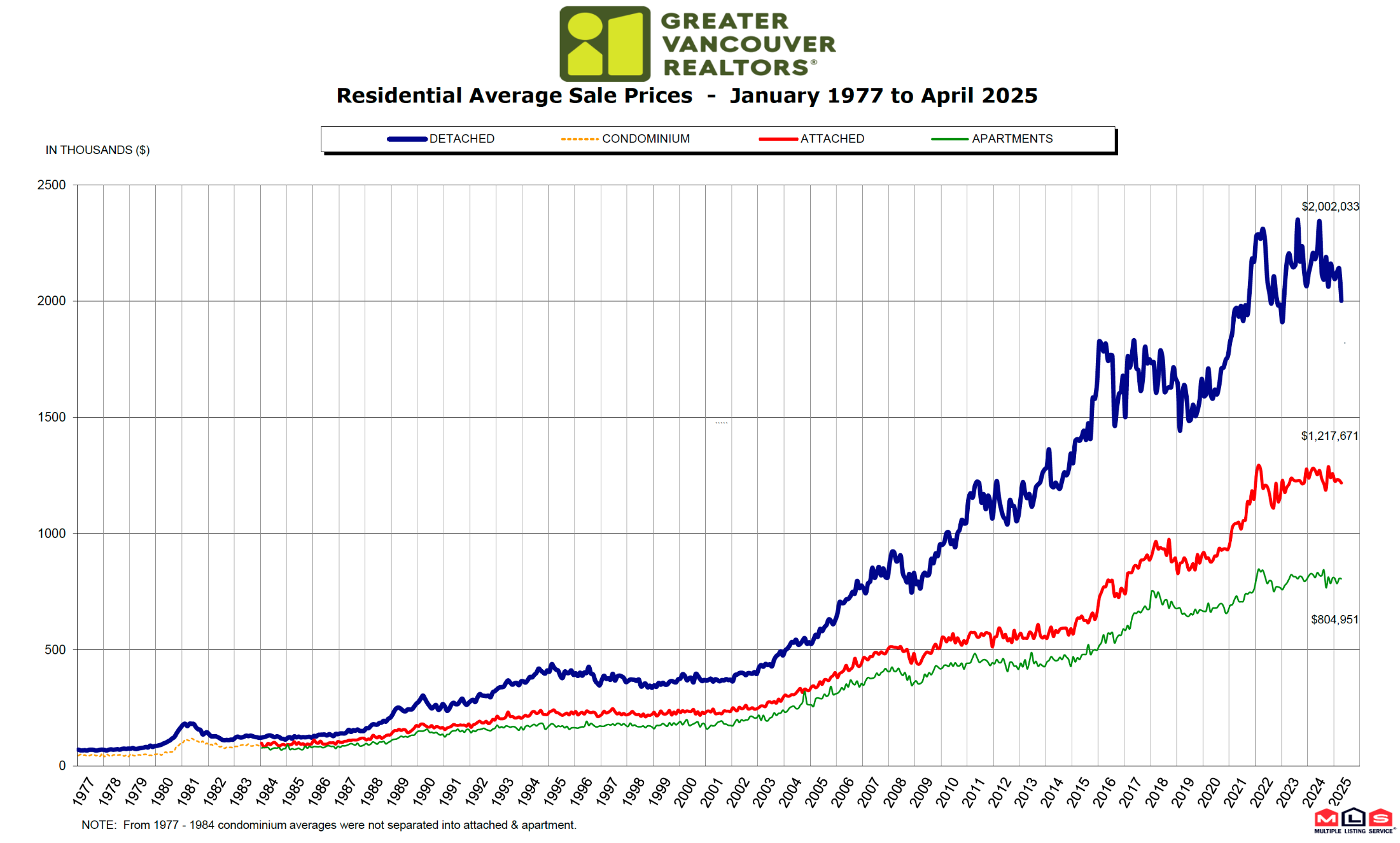

The MLS Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,184,500. This represents a 1.8% decrease over April 2024 and a 0.5% decrease compared to March 2025.

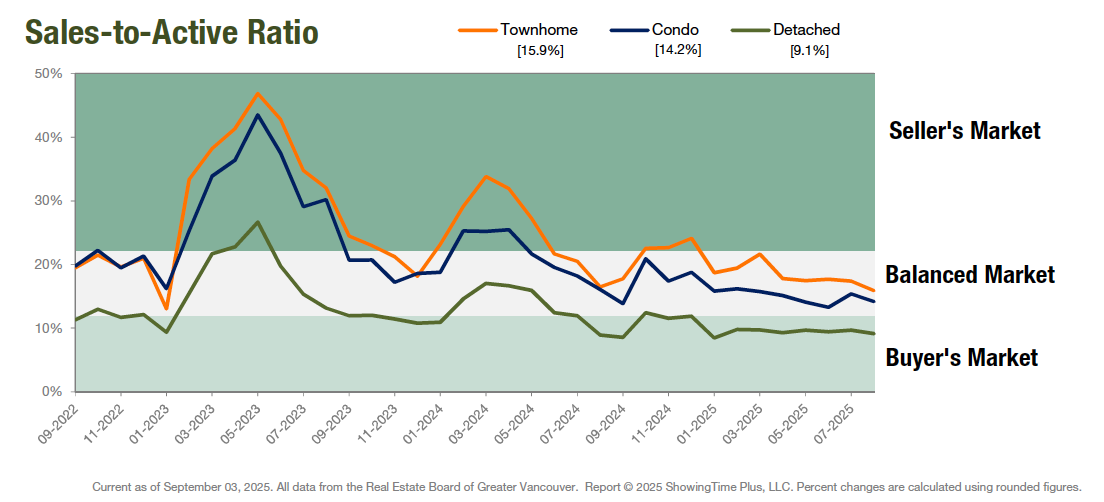

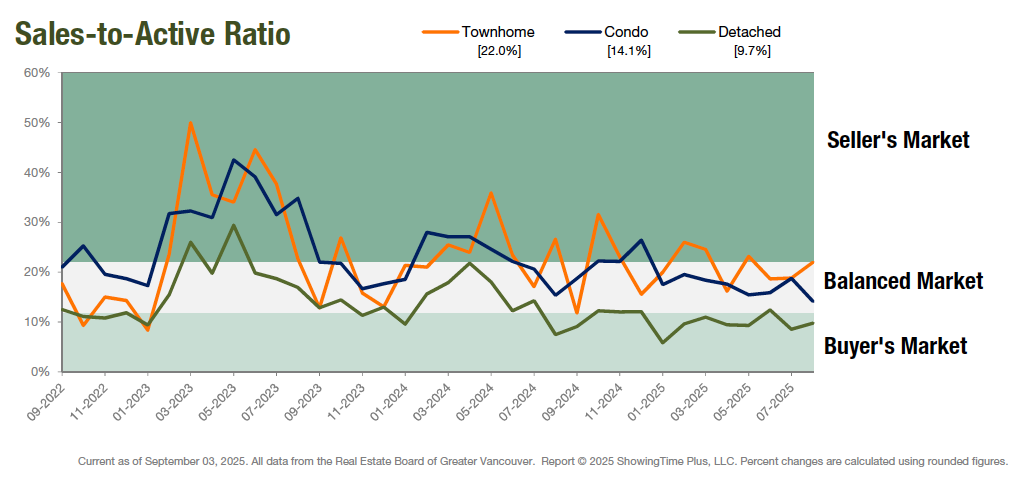

Sales of detached homes in April 2025 reached 578, a 29% decrease from the 814 detached sales recorded in April 2024. The benchmark price for a detached homes $2,021,800. This represents a 0.7% decrease from April 2024 and a 0.6% decrease compared to March 2025.

Sales of apartment homes reached 1,130 in April 2025, a 20.2% decrease compared to the 1,416 sales in April 2024. The benchmark price of an apartment home is $762,800. This represents a 2% decrease from April 2024 and a 0.6% decrease compared to March 2025.

Attached home sales in April 2025 totalled 442, a 23.8% decrease compared to the 580 sales in April 2024. The benchmark price of a townhouse is $1,102,300. This represents a 2.9% decrease from April 2024 and a 1% decrease compared to March 2025.